Retail Banking App: Bridging Physical and Digital Experiences with Money

Overview

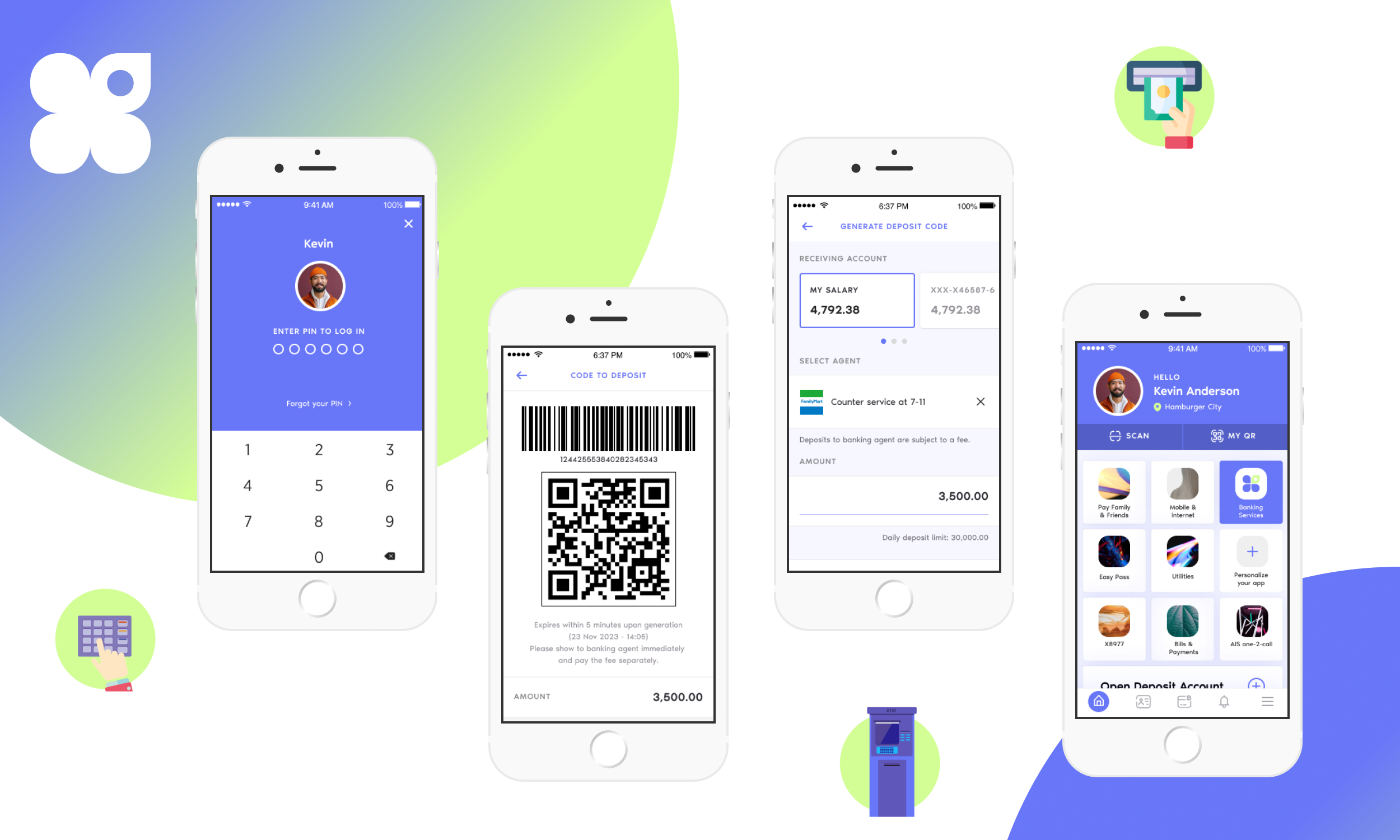

Collaborating closely with product managers and developers, we embarked on a mission to enhance the experience and convenience of cash withdrawal for retail customers. Our goal was to provide an alternative to using a card or facing the inconvenience of distant ATM branches. Leveraging the power of the mobile banking app, we aimed to create seamless journeys for cardless ATM withdrawal and banking agents.

For client confidentiality, all project images, content, and branding have been redacted.

Role

Lead Product Designer

Activities

Project planning, Oversee scope, timelines and research processes, Drive research activities,

Output

Mobile App

Duration

July 2018 - August 2019

The Process

Design Sprints in Action

Our design process kicked off by refining user stories and honing requirements. We crafted screen flows using a mix of wireframes and high-fidelity screens, accounting for negative and retry scenarios.

Throughout the process, I led a team of junior designers, facilitating seamless communication between product owners, stakeholders, and developers to refine screens based on feasibility and usability considerations.

Guerilla Testing

To efficiently connect with users, we incorporated guerilla testing into our process. This involved approaching customers in the building, conducting quick 5-minute tests using prototypes, and gathering valuable feedback through rapid usability testing.

Based on user feedback, we returned to the drawing board, identifying patterns and findings to inform our recommendations. We shared our insights with the working team and made necessary changes. Once finalized, we ensured the measurements, quality, and completeness of the screens, preparing them for translation by copywriters and subsequent development.

In a subsequent sprint timelines, we conducted a thorough quality check of the developed features, meticulously identifying areas for improvement.

The Results

The redesign of the mobile app experience led to an astounding 200% increase in retail banking customers, with the cardless ATM function emerging as the most utilized feature within the app.