HSBC Insurance Singapore

Role

Lead User Experience Consultant

Activities

Discovery Research, User Flows, Wireframes, High-Fidelity Designs, A/B Usability Testing

Output

Mobile Responsive Website

Duration

July - December 2017

Background

HSBC Singapore entrusted Mirum Singapore to boost insurance applications and purchases through the creation of their first mobile-responsive website.

We took on the challenge of designing the experience of insurance purchase for customers, keeping in mind how much we can stretch HSBC’s expansive yet rigorous design system.

User research formed the foundation of our approach, driving persona creation, empathy mapping, and user journeys.

This project is dated, and the current website may differ from the designs and processes discussed in this case study.

Identifying Personas: Motivations, Goals, and Needs

Mapping the Pains and Gains

Capturing Opportunities

Sample User Flow for Insurance Purchase Form

From Wireframes to Design Prototypes

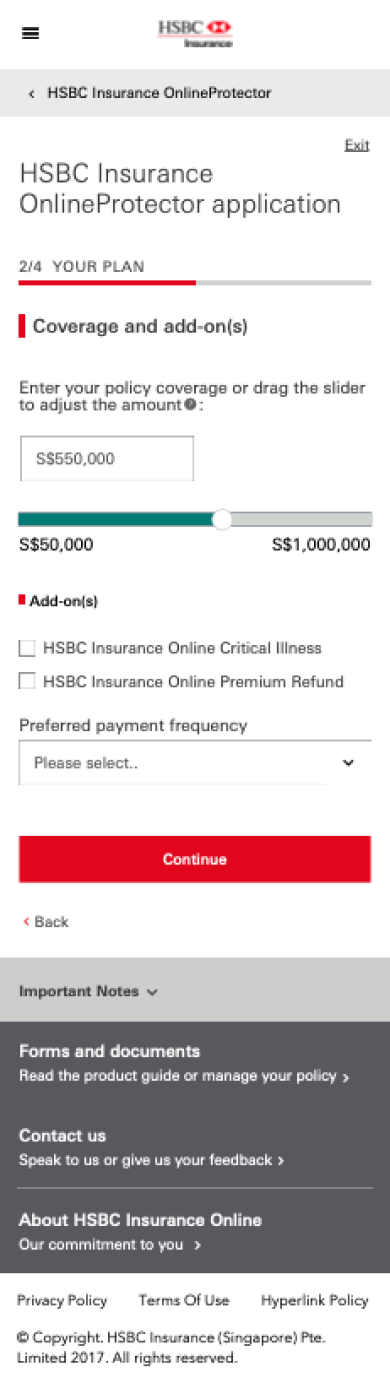

Insights from the research guided our wireframes and concepts, highlighting the interaction design as key differentiation of the user experience: type form vs. traditional form.

Traditional Form

Type Form

A/B Testing the Concepts

Working closely with the bank, we had the unique opportunity to explore two distinct approaches for insurance applications through an A/B usability study.

Our usability lab, equipped with an eye-tracking tool, enabled us to measure efficiency and completion time between two forms, extracting invaluable findings to determine the most effective option.

The Results

The findings indicated that users liked the typeform more than the traditional form because it made it easier to understand what they needed to do and complete the form successfully. However, some users mentioned that it could have been a bit long and tricky to go back to previous questions.

The redesigned form meets HSBC Singapore's goal of revolutionizing insurance applications: making it user-friendly, one click at a time.

Behind the Scenes using an Eye tracker